China's Dairy Industry Stabilizes as Mega-farms Dominate Production

The United States Department of Agriculture (USDA) projects that China's dairy industry will reach a phase of structural stability by 2026. This follows a period of volatility characterized by declining milk prices since 2022. As a result, smaller dairy producers have exited the market, leading to a consolidation of production within larger industrial operations.

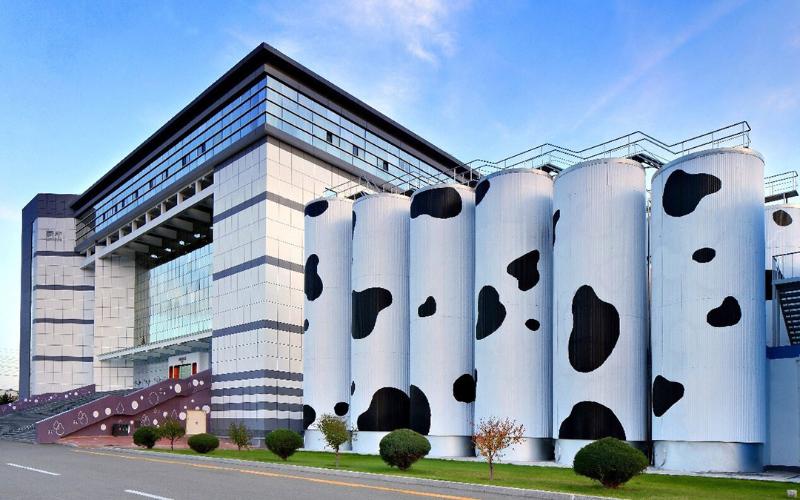

According to the USDA's office in Beijing, mega-farms now account for over 68% of China's total milk production. This marks an increase of more than 2% compared to the previous year. The consolidation trend reflects a broader global pattern where operations with economies of scale dominate markets with compressed profit margins.

China's local dairy production is gradually reducing its historic dependency on imports. Although fluid milk imports are expected to decline slightly by 2026, the production of skim milk powder is projected to increase, maintaining current import levels. Despite this progress, China remains reliant on foreign suppliers for specialized dairy products where domestic competitiveness is still developing.

The USDA also forecasts a slight growth in both the production and importation of butter and cheese. Meanwhile, imports of whey and derivatives are expected to remain strong. These projections highlight strategic opportunities for global exporters, as China's domestic market continues to evolve.

Overall, the shift towards mega-farm dominance and increased local production are reshaping the dairy supply chain in China, with implications for technology, bovine genetics, feed, and specialized veterinary services. This transformation is steering China's dairy industry towards efficiency and biosecurity standards comparable to leading Western dairy regions.