Kazakhstan Increases Horse and Pig Exports, Reduces Cattle Shipments

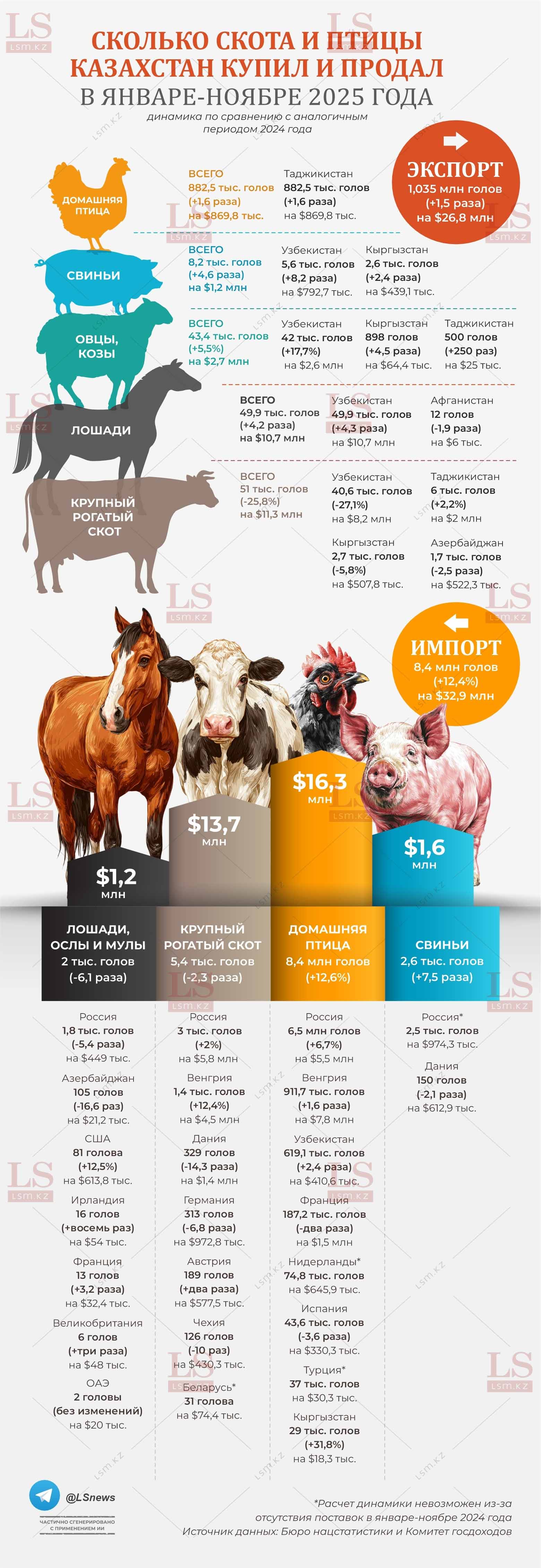

The majority of the export volume in physical terms was traditionally made up by domestic poultry — 882,500 heads, including chickens, turkeys, and geese. Shipments increased 1.6 times, with the entire volume directed to Tajikistan.

The most notable growth was observed in the export of horses, which increased by 4.2 times, reaching nearly 50,000 heads. The key market was Uzbekistan, which received 49,900 horses (an increase of 4.3 times). A small batch of 12 heads was sent to Afghanistan, which is half the level of the previous year.

Pig exports also saw a significant increase — by 4.6 times, reaching 8,200 heads. The main volumes were also directed to Uzbekistan (5,600 heads, an increase of 8.2 times) and Kyrgyzstan (2,600 heads, an increase of 2.4 times).

Shipments of sheep and goats increased moderately — by 5.5%, to 43,400 heads. These animals were also predominantly shipped to Uzbekistan and Kyrgyzstan.

Amid the overall growth in shipments, the export of cattle showed a negative trend. Cattle exports decreased by 25.8%, to 51,000 heads. Uzbekistan remained the main destination (40,600 heads, a decrease of 27.1%). Shipments to Tajikistan increased by 2.2% (6,000 heads), while shipments to Kyrgyzstan and Azerbaijan decreased.

The import of livestock and poultry into Kazakhstan during the reporting period increased by 12.4% and reached 8.4 million heads. Almost the entire volume was accounted for by poultry — 8.4 million heads (an increase of 12.6%). Russia became the main supplier (6.5 million heads), followed by Hungary, Uzbekistan, and France. Small batches also came from the Netherlands, Turkey, Spain, and Kyrgyzstan.

Meanwhile, cattle imports decreased by 2.3 times, to 5,400 heads. Animals were imported from Russia, Hungary, Denmark, Germany, Austria, the Czech Republic, and Belarus.

Imports of horses, mules, and donkeys decreased even more sharply — by 6.1 times, to 2,000 heads. The main shipments came from Russia and Azerbaijan, although there was an increase in the import of breeding animals from the USA, Ireland, France, the UK, and the UAE.

Previously, a member of the relevant union, Maksut Baktibaev, noted that the rise in meat prices in Kazakhstan is more associated with a decrease in livestock numbers rather than exports. According to his assessment, the country exports about 15,000 tons of beef annually — approximately 3% of domestic consumption, which cannot have a decisive impact on price dynamics.

In light of persistent deficit risks, at the end of 2025, the authorities extended restrictions on meat exports for another six months, while simultaneously declaring their readiness to ensure the saturation of the domestic market.