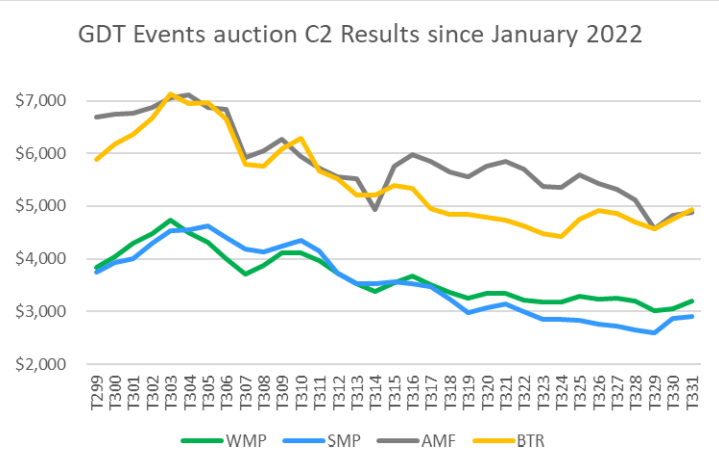

GDT results 2 May'23

In the 2nd of May GDT Events auction, all products, specifications, and contract periods saw an increase of 2.5%, continuing the positive trend from the previous auction. WMP had the highest increase at 5.0%, followed by cheddar (4.5%), butter (2.4%), and SMP (1.5%). BMP had a small increase of 0.8%, while AMF dropped by 2.4%.

In the 2nd of May GDT Events auction, all products, specifications, and contract periods saw an increase of 2.5%, continuing the positive trend from the previous auction. WMP had the highest increase at 5.0%, followed by cheddar (4.5%), butter (2.4%), and SMP (1.5%). BMP had a small increase of 0.8%, while AMF dropped by 2.4%.

The forward curves in today's auction were particularly interesting and may reveal more about the market than the headline results alone. For example, WMP C2 rose by $135/ 4.4% to $3190, retracing all losses since the March 21st auction. The positive forward curve also showed strength, with a $120 differential across C2 through C5 ($3300).

SMP Regular C2 rose by $40 / 1.4% to $2900, the strongest finish since December 20th, 2022. C1 traded at a premium of $165 / 5.7% over the benchmark contract period. The backwardated forward curve with a $125 / 3.9% discount for C5 versus C2 may indicate a short-term, origin-specific tightness, with less concern further out. European and US SMP/NFDM also finished at a significant discount to Oceania, suggesting origin-specific tightness.

Although the AMF complex had an overall negative result, the C2 Premium contract finished $50 / 1.0% higher than at the prior event ($4880 vs $4830). C1 traded at a $370 / 7.6% discount. This may suggest light prompt demand relative to forward, with further out months trading at a premium to C2, albeit with a lower premium relative to C2 than at the prior auction.

Unsalted Butter C2 performed well and finished $190 / 4.0% higher than at the April 18th auction. C1 traded at a $70 / 1.4% premium, but the forward months were backwardated to the tune of $100 / 2.0% at C5 relative to C2.